Alcohol in the North East

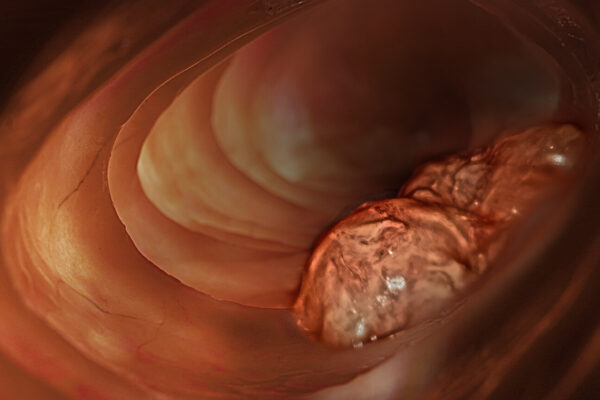

The North East suffers disproportionately from alcohol harm with the highest rates of alcohol-related hospital admissions and alcohol specific deaths in England.

Alcohol is estimated to cost North East public services and employers over one billion pounds a year – around £1.01bn in 2015/16 – but this is likely to be an under-estimate with the pandemic and cost of living crisis fuelling higher levels of consumption and record deaths.

Post pandemic, we know nearly half of adults in our region (47%) are drinking above recommended low risk guidelines – around 850,000 people and six out of ten men, and more people who drink are bingeing.

Read our report “Alcohol and Covid – A Perfect Storm” from a survey of 907 people, 2022.

What we do

Balance the North East alcohol programme is working to reduce alcohol harms at a population level, to ensure our population is better informed and is calling for effective national action.

We are seeking a societal shift around alcohol use by changing the culture in which alcohol and drinking at levels harmful to health becomes less desirable, less acceptable, less affordable and less accessible. We have learned from the tobacco experience and know there are key lessons from this in terms of how to address alcohol.

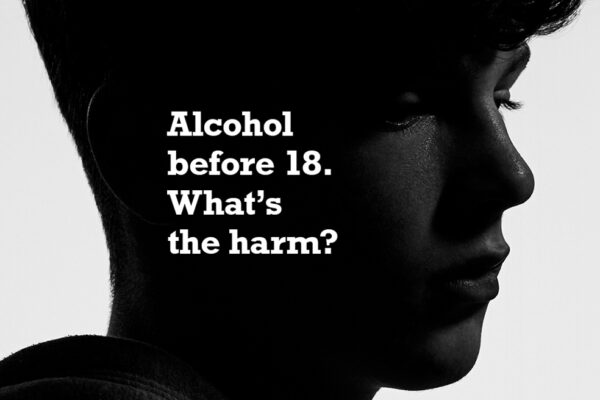

The need for action and awareness has never been greater. Balance is delivering a programme of key strands designed to work together to support local colleagues, raise awareness of health risks and encourage people to cut down and to protect children and families from alcohol harm.

Alcohol companies depend on people drinking above the guidelines to maintain current profit levels for shareholders. That means effective action also requires vigilance of alcohol industry activities around promotion, price and availability.

Balance supports local colleagues working in alcohol, runs regular campaigns to highlight the health risks from alcohol as a product and is a core member of the Alcohol Health Alliance campaigning for action on alcohol at national level.

Latest news and stories

View all news and storiesLatest campaigns

View all campaignsExplore more Balance pages

What we do

There is no silver bullet when it comes to addressing alcohol harms. However, learning from tobacco control and the evidence-base around public health, there needs to be a multi-strand approach to alcohol harm reduction.

Reduce your drinking:

If you’re looking for support to reduce or stop drinking visit, reducemyrisk.tv